Filling Out the IRS W-9 Form for Federal Tax Compliance

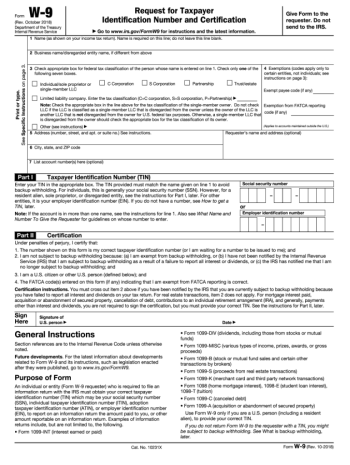

The world of taxation can often be a labyrinthine puzzle, full of complex paperwork and critical deadlines. Central to many financial interactions in the United States is the IRS Form W-9, a crucial document formally requesting an individual's or a company's Taxpayer Identification Number (TIN). It serves as a means for entities to accurately report income paid to contractors, freelancers, and others engaged in a business relationship where employment taxes are not withheld. Without federal form W-9, entities may struggle to comply with IRS regulations and could face reporting issues that can complicate their tax obligations.

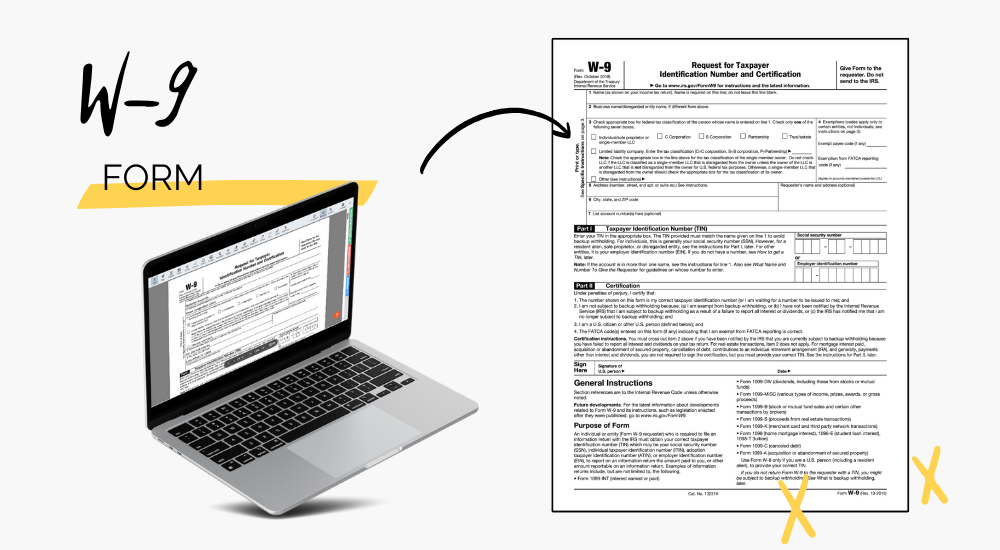

At our website, w9-irsform.com, the seemingly daunting task of filling out the blank W-9 form is simplified. Our website offers a free printable IRS W-9 form with additional resources that will help you complete the document correctly. Materials on our site, such as detailed instructions and real-life examples, are designed to alleviate confusion and assist users in providing accurate information. Whether you are new to the process or looking for the option to download Form W-9 in PDF format, w9-irsform.com is an invaluable resource.

Table of Contents

Example of the W-9 Form Value for Employee

- When it comes to official documentation, the printable W-9 IRS tax form serves as a request for identity verification. It is not filed with the IRS but retained by the person or entity that has requested it and then used for reporting purposes at the end of the financial year. Any individual or entity paid for services, from independent contractors to freelance creatives, often needs to provide this form. It is also used in real estate transactions and mortgage interest reporting.

- Imagine Jane Doe, an independent graphic designer freelancing for multiple tech startups. In the year 2024, she has been contracted by a new client who requires her design skills for an upcoming project. Before Jane can receive her payment, her client asks her to complete the W9 IRS form for 2024 to ensure they have her correct tax information on file. Since Jane runs her own business and receives compensation not subject to tax withholding, she must accurately complete the form following the W9 instructions so her client can appropriately report the payments to the IRS.

Steps to Fill Out Blank IRS W9 Form

When approaching the IRS W9 form for 2024 in PDF format using w9-irsform.com, individuals can follow these structured steps to ensure accuracy and timeliness:

- Navigate to w9-irsform.com and access the blank W-9 IRS form.

- Ensure you have all necessary information, including your TIN or Social Security Number.

For instance, freelancers should ensure they use their personal Social Security Number if they don't have an Employer Identification Number (EIN). A common mistake is using an incorrect or outdated TIN, which can lead to issues with tax reporting. - Carefully enter your name and business name (if applicable) as it appears on your tax returns.

- Check the appropriate tax classification box that represents your status.

A sole proprietor might erroneously check 'individual,' whereas they actually conduct their business as an entity separate from their personal identity. - Add your address and the requestor's name if required.

- Print a free W9 form from the website after completion and provide it to the requester.

- Remember to sign and date the request; an unsigned Form W-9 is considered invalid.

IRS W-9 Form Schedule

The good news is that the current W-9 form by the IRS does not have a specific due date since it is not filed like other tax forms. Instead, it should be completed and provided promptly upon request by the person or entity that is paying for services or transactions triggering the need for it. This ensures that they can meet their own reporting deadlines in a timely manner.

For example, a company may need your W9 IRS for 2024 to prepare 1099-MISC for non-employee compensation before January 31st of the following year. Therefore, submitting your information as soon as possible allows these entities to meet their obligations immediately. There isn't a provision for an extension since this request isn't filed with the IRS directly; however, providing accurate information speedily helps all parties avoid complications.

IRS Tax Form W-9 & Potential Penalties

Missteps with taxation forms invite various repercussions, and adherence to protocol when dealing with 2024 IRS Form W-9 is instrumental in evading such outcomes. Failure to comply can lead to punitive measures enforced by the IRS.

Reasons one may incur penalties include:

- Failing to provide Form W-9 when requested by a business or other income provider.

- Supplying false or misleading information on the form.

- Failing to report all changes in circumstance, including a name or address change.

Each instance carries the potential for financial repercussions or legal challenges that can have lasting effects on one's fiscal responsibilities. Therefore, maintaining up-to-date and veritable information on one's IRS printable W9 form is key to ensuring peaceable operations within the frameworks set by taxation laws.

W-9 Request Form: Questions & Answers

- What is the purpose of IRS Form W-9, and when should I use it?It's utilized primarily by businesses to gather information from individuals who provide freelance or contract services. These details are necessary to prepare Form 1099, which reports non-employee compensation. Whenever a business engages a service from an independent contractor, they are likely to request a completed W-9 for their records.

- How can I obtain the IRS Form W9 for 2024 printable version?Anyone who needs the W-9 template can easily acquire it by visiting our website. Here, you can download the form in a convenient PDF format, making it simple to print and utilize for your contracting or freelance taxation needs. Ensuring you have the most current version is crucial for adherence to the updated tax guidelines.

- Is it possible to fill out the IRS W-9 fillable form for 2024 online?Yes, you have the ability to fill out the IRS W-9 form directly through our secure online platform. This digital method saves time and ensures accuracy, as it allows individuals to enter their information, save their progress, and make corrections as needed before submitting the form electronically.

- Where can I find a blank W-9 form in PDF format?The request in PDF format can be located on our website, which is designed for convenience and easy access. Users have the option to download this document and either manually fill in their information or use the fillable features to type their details before printing.

- Am I able to print the W9 form for free?Absolutely, our website provides the service to print the blank template for free. Taxpayers can download and print copies of the request without any charge, reinforcing our commitment to making tax compliance as effortless and cost-effective as possible for our users.

More About the W-9 PDF Form for Year 2024

-

![image]() Printable W-9 IRS Tax Form Filling in a W-9 tax form is essential for accurate taxation records and compliance. It's designed for freelancers, independent contractors, and other non-employees to provide their Taxpayer Identification Number (TIN) to the entities that will pay them. The layout of the W-9 tax form printable inc... Fill Now

Printable W-9 IRS Tax Form Filling in a W-9 tax form is essential for accurate taxation records and compliance. It's designed for freelancers, independent contractors, and other non-employees to provide their Taxpayer Identification Number (TIN) to the entities that will pay them. The layout of the W-9 tax form printable inc... Fill Now -

![image]() Free W-9 Form Taxation is an intricate element of financial management. Whether you're an independent contractor, freelancer, or running a business, you'll likely encounter the necessity of providing a W-9 form. The free fillable W-9 form is a critical document employed for tax identification and certification in... Fill Now

Free W-9 Form Taxation is an intricate element of financial management. Whether you're an independent contractor, freelancer, or running a business, you'll likely encounter the necessity of providing a W-9 form. The free fillable W-9 form is a critical document employed for tax identification and certification in... Fill Now -

![image]() Federal Form W-9 (PDF) Taxation in the United States can often appear as a labyrinth of forms and requirements, among which the federal form W-9 in PDF plays a crucial role for individual contractors and businesses that engage their services. This document is used to collect taxpayer identification numbers (TINs), be it a... Fill Now

Federal Form W-9 (PDF) Taxation in the United States can often appear as a labyrinth of forms and requirements, among which the federal form W-9 in PDF plays a crucial role for individual contractors and businesses that engage their services. This document is used to collect taxpayer identification numbers (TINs), be it a... Fill Now -

![image]() W-9 Form Online Tax season often calls for various formalities, and one such task is for individuals or entities to provide their tax identification number (TIN) to the entities that will pay them income during the tax year. The W-9 form, Request for Taxpayer Identification Number and Certification, is critical in... Fill Now

W-9 Form Online Tax season often calls for various formalities, and one such task is for individuals or entities to provide their tax identification number (TIN) to the entities that will pay them income during the tax year. The W-9 form, Request for Taxpayer Identification Number and Certification, is critical in... Fill Now