Form W-9 in PDF and its Role in Taxation

Taxation in the United States can often appear as a labyrinth of forms and requirements, among which the federal form W-9 in PDF plays a crucial role for individual contractors and businesses that engage their services. This document is used to collect taxpayer identification numbers (TINs), be it a Social Security number or an employer identification number, from U.S. persons (including residents and citizens) who are involved in certain financial transactions. Companies require a completed W-9 IRS form in PDF from their contractors for accurate reportage of income paid out throughout the fiscal year, a critical piece in the taxation puzzle that ensures compliance with Internal Revenue Service (IRS) regulations.

Key Alterations to IRS Form W-9 Through the Years

Over recent years, the IRS has updated the W-9 form to simplify its use and address security concerns. Adjustments have included revisions to the certification section, clarifications of the exemptions, and greater emphasis on the penalties for failing to provide accurate information. These iterative changes underscore the IRS's commitment to maintaining current standards and reflecting evolving regulatory requirements. It is important to always access the latest printable W-9 form for 2024 in PDF from the IRS website or a trusted source to ensure you are using the most up-to-date version.

In the ever-evolving financial landscape, remember the significance of opting for the W9 in PDF form for 2024 when engaging in new business relationships or renewing existing ones during this year to ensure compliance with recent guidelines and directives from the IRS. The commitment to staying current with such forms helps mitigate potential issues during tax season.

Who is Eligible to Use Form W-9?

Generally, the fillable W-9 form in PDF is used by those who work as freelancers, independent contractors, or self-employed. For instance, a freelance graphic designer hired by a marketing firm must provide a filled-out W-9 form so the firm can appropriately report payments made to the designer throughout the year on a 1099-MISC copy. However, this form is not used by employees whose earnings are reported via a W-2 sample. Furthermore, it's worth noting that certain exemptions apply, such as payments to a corporation or for merchandise, which typically do not require a W-9.

Optimizing Form W9 Filling Process

Becoming adept at handling the W-9 IRS form can save considerable time and mitigate errors.

- A top suggestion for optimizing the form-filling process includes utilizing the electronic version, specifically a fillable W9 form. This reduces paper waste and improves accuracy, as PDF software typically includes features like automatic formatting and spell-checking.

- Additionally, storing a digital copy simplifies future submissions since updates to personal information can be done swiftly without the need to start the process anew for each request.

- Another recommendation is to stay vigilant about privacy and ensure secure transmission of your completed W-9. Since this form contains sensitive personal information, such as your TIN, safeguarding its transmission is paramount.

- Encrypting emails and using secure file-sharing services constitute good practices.

- Lastly, individuals and businesses are encouraged to maintain updated records, promptly addressing requests for a W-9 and ensuring that all information matches current IRS records for consistency and compliance.

Related Forms

-

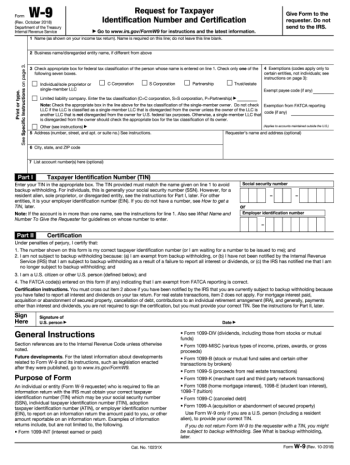

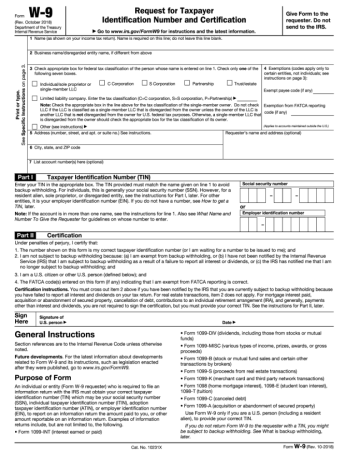

![image]() W-9 The world of taxation can often be a labyrinthine puzzle, full of complex paperwork and critical deadlines. Central to many financial interactions in the United States is the IRS Form W-9, a crucial document formally requesting an individual's or a company's Taxpayer Identification Number (TIN). It serves as a means for entities to accurately report income paid to contractors, freelancers, and others engaged in a business relationship where employment taxes are not withheld. Without federal form... Fill Now

W-9 The world of taxation can often be a labyrinthine puzzle, full of complex paperwork and critical deadlines. Central to many financial interactions in the United States is the IRS Form W-9, a crucial document formally requesting an individual's or a company's Taxpayer Identification Number (TIN). It serves as a means for entities to accurately report income paid to contractors, freelancers, and others engaged in a business relationship where employment taxes are not withheld. Without federal form... Fill Now -

![image]() Printable W-9 IRS Tax Form Filling in a W-9 tax form is essential for accurate taxation records and compliance. It's designed for freelancers, independent contractors, and other non-employees to provide their Taxpayer Identification Number (TIN) to the entities that will pay them. The layout of the W-9 tax form printable includes several main fields, such as the name of the individual or entity, their business name if different, their TIN (which can be a Social Security Number or Employer Identification Number), and their address. Getting acquainted with the W-9 IRS tax form is vital for all entities who will engage in an employment arrangement with parties frequently requiring it. Printable W9 Form: Step-by-Step Instructions for Completing Begin with your legal name – ensure it matches the name on your tax return. Add your business name or disregarded entity name if it differs from the name in the first field. Choose the federal tax classification that best describes your status – individual/sole proprietor, C Corporation, S Corporation, Partnership, Trust/estate, Limited liability company, or other. Provide your current address, including the city, state, and ZIP code. Enter the requestor’s name and address if it is already known. Provide your TIN, which could be your Social Security Number (SSN) or Employer Identification Number (EIN), in the appropriate field. Review the form thoroughly for accuracy. Lastly, ensure you sign and date the form, as an unsigned form is considered invalid. Proper Submission of Form W-9 After carefully finishing the free printable W9 tax form, the next step is the submission process. Typically, the requester of the form, who needs to collect the information for their tax reporting purposes, will provide instructions on how they wish to receive it. In many cases, the form can be mailed, faxed, or securely emailed. It is critical to follow their protocol to ensure safe transmission of your sensitive personal information. It is advised always to inquire from the requester about their preferred method of submission if it is not explicitly stated. Printable W-9 Form and Important Dates While the W-9 form does not have a defined IRS deadline like other tax forms, it is important to submit it as soon as it is requested. This is because the entity paying you will need it to accurately report the payments they make to you by issuing Form 1099-NEC, when necessary, at the beginning of the following year. Thus, the printable W9 form for 2024, free of errors and submitted on time, ensures that both parties comply with tax laws and avoid potential penalties for late or incorrect reporting. In closing, always remember that having a blank printable W9 form on hand is beneficial. Downloading and printing the printable W-9 IRS tax form is straightforward – it's available on our website and can save you time when a client or employer requires it. Storing a couple of physical copies safely and securely is a proactive step that can make tax-related procedures smoother for all parties involved. Fill Now

Printable W-9 IRS Tax Form Filling in a W-9 tax form is essential for accurate taxation records and compliance. It's designed for freelancers, independent contractors, and other non-employees to provide their Taxpayer Identification Number (TIN) to the entities that will pay them. The layout of the W-9 tax form printable includes several main fields, such as the name of the individual or entity, their business name if different, their TIN (which can be a Social Security Number or Employer Identification Number), and their address. Getting acquainted with the W-9 IRS tax form is vital for all entities who will engage in an employment arrangement with parties frequently requiring it. Printable W9 Form: Step-by-Step Instructions for Completing Begin with your legal name – ensure it matches the name on your tax return. Add your business name or disregarded entity name if it differs from the name in the first field. Choose the federal tax classification that best describes your status – individual/sole proprietor, C Corporation, S Corporation, Partnership, Trust/estate, Limited liability company, or other. Provide your current address, including the city, state, and ZIP code. Enter the requestor’s name and address if it is already known. Provide your TIN, which could be your Social Security Number (SSN) or Employer Identification Number (EIN), in the appropriate field. Review the form thoroughly for accuracy. Lastly, ensure you sign and date the form, as an unsigned form is considered invalid. Proper Submission of Form W-9 After carefully finishing the free printable W9 tax form, the next step is the submission process. Typically, the requester of the form, who needs to collect the information for their tax reporting purposes, will provide instructions on how they wish to receive it. In many cases, the form can be mailed, faxed, or securely emailed. It is critical to follow their protocol to ensure safe transmission of your sensitive personal information. It is advised always to inquire from the requester about their preferred method of submission if it is not explicitly stated. Printable W-9 Form and Important Dates While the W-9 form does not have a defined IRS deadline like other tax forms, it is important to submit it as soon as it is requested. This is because the entity paying you will need it to accurately report the payments they make to you by issuing Form 1099-NEC, when necessary, at the beginning of the following year. Thus, the printable W9 form for 2024, free of errors and submitted on time, ensures that both parties comply with tax laws and avoid potential penalties for late or incorrect reporting. In closing, always remember that having a blank printable W9 form on hand is beneficial. Downloading and printing the printable W-9 IRS tax form is straightforward – it's available on our website and can save you time when a client or employer requires it. Storing a couple of physical copies safely and securely is a proactive step that can make tax-related procedures smoother for all parties involved. Fill Now -

![image]() Free W-9 Form Taxation is an intricate element of financial management. Whether you're an independent contractor, freelancer, or running a business, you'll likely encounter the necessity of providing a W-9 form. The free fillable W-9 form is a critical document employed for tax identification and certification in the United States, ensuring that the correct information is furnished to employers and financial institutions. Imagine an independent graphic designer landing a new client. Before proceeding with the project, the client requests a completed W-9 form. In another case, consider a small business owner who has hired a freelance content writer for website development; a W-9 form will also be required for tax reporting purposes. A viable solution for these individuals is to access and submit a free W9 online form, which streamlines the process and ensures timely compliance. Federal Form W-9: Complex Scenarios and Practical Resolutions It is worth noting that even shareholders in a corporation may be asked to complete a W-9 form, especially when distributions or dividends are paid out. In this instance, the shareholder would seek out a free W9 form online to fulfill the request, ensuring receipt of earnings without unnecessary delays. Another noteworthy circumstance involves an individual or entity that has undergone a significant change, such as a merger or acquisition. Adjustments to the information previously provided on the W-9 form must be promptly addressed. Locating a free W-9 form in PDF format and providing updated info ensures that the tax records correctly reflect the current status of the entity or individual. The Importance of the Free W-9 Form Accuracy is paramount when completing tax-related forms, and false information can lead to penalties or audits. Therefore, in the event of an error, one must rectify the mistake at the earliest. Should a taxpayer mistakenly provide incorrect details, it is advisable to resubmit the corrected W-9 form to all pertinent parties. Proactive correction demonstrates due diligence and can prevent complications stemming from misinformation. As the free W9 form for 2024 becomes available, it must be filled out with utmost precision to avoid pitfalls related to tax identification and reporting. IRS W9 Form: Frequently Asked Questions What should I do if I am asked for a W-9 form but do not have one readily available?You can quickly obtain the request template by downloading it directly from our website or other credible sources. Is it possible to submit Form W-9 electronically?Yes, the IRS acknowledges electronic submissions, and many institutions accept the editable version, which can be completed and sent via secure channels. How often do I need to update and resubmit a W-9 form?A W-9 form should be resubmitted whenever your personal information, such as name or address changes or your tax ID number, is updated. Fill Now

Free W-9 Form Taxation is an intricate element of financial management. Whether you're an independent contractor, freelancer, or running a business, you'll likely encounter the necessity of providing a W-9 form. The free fillable W-9 form is a critical document employed for tax identification and certification in the United States, ensuring that the correct information is furnished to employers and financial institutions. Imagine an independent graphic designer landing a new client. Before proceeding with the project, the client requests a completed W-9 form. In another case, consider a small business owner who has hired a freelance content writer for website development; a W-9 form will also be required for tax reporting purposes. A viable solution for these individuals is to access and submit a free W9 online form, which streamlines the process and ensures timely compliance. Federal Form W-9: Complex Scenarios and Practical Resolutions It is worth noting that even shareholders in a corporation may be asked to complete a W-9 form, especially when distributions or dividends are paid out. In this instance, the shareholder would seek out a free W9 form online to fulfill the request, ensuring receipt of earnings without unnecessary delays. Another noteworthy circumstance involves an individual or entity that has undergone a significant change, such as a merger or acquisition. Adjustments to the information previously provided on the W-9 form must be promptly addressed. Locating a free W-9 form in PDF format and providing updated info ensures that the tax records correctly reflect the current status of the entity or individual. The Importance of the Free W-9 Form Accuracy is paramount when completing tax-related forms, and false information can lead to penalties or audits. Therefore, in the event of an error, one must rectify the mistake at the earliest. Should a taxpayer mistakenly provide incorrect details, it is advisable to resubmit the corrected W-9 form to all pertinent parties. Proactive correction demonstrates due diligence and can prevent complications stemming from misinformation. As the free W9 form for 2024 becomes available, it must be filled out with utmost precision to avoid pitfalls related to tax identification and reporting. IRS W9 Form: Frequently Asked Questions What should I do if I am asked for a W-9 form but do not have one readily available?You can quickly obtain the request template by downloading it directly from our website or other credible sources. Is it possible to submit Form W-9 electronically?Yes, the IRS acknowledges electronic submissions, and many institutions accept the editable version, which can be completed and sent via secure channels. How often do I need to update and resubmit a W-9 form?A W-9 form should be resubmitted whenever your personal information, such as name or address changes or your tax ID number, is updated. Fill Now -

![image]() W-9 Form Online Tax season often calls for various formalities, and one such task is for individuals or entities to provide their tax identification number (TIN) to the entities that will pay them income during the tax year. The W-9 form, Request for Taxpayer Identification Number and Certification, is critical in this process. This form is a key document used in the United States tax system by freelancers, independent contractors, and others to furnish their correct TIN to the person required to file information returns with the IRS. Its structure comprises key information such as the individual's name, address, TIN (which may be a Social Security number or an Employer Identification Number), and certification that the TIN provided is correct. Advantages of a Fillable W-9 Form In the digital age, convenience and efficiency are paramount, and the ability to fill out the W9 form online offers several advantages. For beginning, the free, fillable form ensures that individuals can easily type in the required information, which improves legibility and decreases the chances of errors that could occur when completing the request by hand. Additionally, digital forms can be saved and reused, reducing the need for repetitive entry of the same information for different requesters. This modern convenience permits swift compliance with tax obligations. Moreover, searching for the free W-9 form online provides immediate access to the current year’s template. For instance, individuals and businesses looking to prepare for the upcoming tax season can find the W9 online form for 2024 readily available for download and submission. This ensures that taxpayers are utilizing the most up-to-date form with any changes that may have been implemented by the IRS. Challenges When Opting to File W9 Online While filing the W-9 form online is indeed efficient, it does not come without potential challenges. One of the chief concerns is the compatibility of digital forms with various devices and software. Users may encounter issues where certain fields do not display properly or their information doesn't save as expected. This can lead to incomplete forms or the need to start the process anew, thus highlighting the importance of ensuring one's technological setup is adequate for online form filing. Best Practices for Online W-9 Submission To successfully file W9 online, it is important to follow certain guidelines. First, ensure that the source of the W-9 form is reputable and corresponds with the official IRS version. After downloading the form, it's crucial to allocate sufficient time to review all information entered before submission thoroughly. Double-checking entries for accuracy and completeness can save considerable time and potential headaches in the future. Moreover, printing and retaining a copy for your records is advisable. Safeguarding Personal Information Online When you decide to get the W9 form online, taking steps to protect your sensitive personal information is imperative. Utilize secure internet connections and avoid public Wi-Fi networks when entering your TIN and other personal data. Additionally, ensure that your device has up-to-date antivirus software. Considering the sensitive nature of the information on the W-9 form, it's also wise to avoid emailing the completed form. Instead, opt for secure portals or encrypted email options offered by the form requester. Fill Now

W-9 Form Online Tax season often calls for various formalities, and one such task is for individuals or entities to provide their tax identification number (TIN) to the entities that will pay them income during the tax year. The W-9 form, Request for Taxpayer Identification Number and Certification, is critical in this process. This form is a key document used in the United States tax system by freelancers, independent contractors, and others to furnish their correct TIN to the person required to file information returns with the IRS. Its structure comprises key information such as the individual's name, address, TIN (which may be a Social Security number or an Employer Identification Number), and certification that the TIN provided is correct. Advantages of a Fillable W-9 Form In the digital age, convenience and efficiency are paramount, and the ability to fill out the W9 form online offers several advantages. For beginning, the free, fillable form ensures that individuals can easily type in the required information, which improves legibility and decreases the chances of errors that could occur when completing the request by hand. Additionally, digital forms can be saved and reused, reducing the need for repetitive entry of the same information for different requesters. This modern convenience permits swift compliance with tax obligations. Moreover, searching for the free W-9 form online provides immediate access to the current year’s template. For instance, individuals and businesses looking to prepare for the upcoming tax season can find the W9 online form for 2024 readily available for download and submission. This ensures that taxpayers are utilizing the most up-to-date form with any changes that may have been implemented by the IRS. Challenges When Opting to File W9 Online While filing the W-9 form online is indeed efficient, it does not come without potential challenges. One of the chief concerns is the compatibility of digital forms with various devices and software. Users may encounter issues where certain fields do not display properly or their information doesn't save as expected. This can lead to incomplete forms or the need to start the process anew, thus highlighting the importance of ensuring one's technological setup is adequate for online form filing. Best Practices for Online W-9 Submission To successfully file W9 online, it is important to follow certain guidelines. First, ensure that the source of the W-9 form is reputable and corresponds with the official IRS version. After downloading the form, it's crucial to allocate sufficient time to review all information entered before submission thoroughly. Double-checking entries for accuracy and completeness can save considerable time and potential headaches in the future. Moreover, printing and retaining a copy for your records is advisable. Safeguarding Personal Information Online When you decide to get the W9 form online, taking steps to protect your sensitive personal information is imperative. Utilize secure internet connections and avoid public Wi-Fi networks when entering your TIN and other personal data. Additionally, ensure that your device has up-to-date antivirus software. Considering the sensitive nature of the information on the W-9 form, it's also wise to avoid emailing the completed form. Instead, opt for secure portals or encrypted email options offered by the form requester. Fill Now -

![image]() W9 Tax Form Copy When engaging in various financial and business transactions within the United States, a critical document often comes into play - IRS Form W-9. This form serves a vital function for both individuals and entities, especially when it pertains to tax reporting requirements. The primary purpose of the W-9 tax form is to gather taxpayer identification numbers (TINs), which typically include a person's Social Security Number (SSN) or an employer identification number (EIN). Businesses often require individuals and entities to furnish a W9 blank copy to correctly report income paid to the IRS during the fiscal year. Who Should Not Use Form W-9 Despite its broad applicability, certain individuals are exempt from using Form W-9. Typically, this includes non-resident aliens, corporations that are not S corporations, and limited liability companies that are taxed as corporations, among others. These entities and individuals must use different documentation, such as Form W-8, to adhere to their unique tax reporting obligations. Form W-9 in Practice: A Hypothetical Scenario Consider Jane Doe, an independent graphic designer who just landed a contract with a new client. Before she can receive any payment, her client requests that she provide a copy of the W9 form. Jane finds a free copy of the W9 form online, fills it out with her details, including her SSN, and submits it to her client. By doing so, Jane ensures that her client can accurately report the compensation paid to her for her services at the year's end. This information will appear on the Form 1099-NEC that Jane will receive, detailing the total payments, which she can then use when filing her taxes. Common Issues and Solutions with Form W-9 Common Issues Solutions Difficulty in obtaining a W-9 form Individuals can easily get a copy of the W9 directly from the IRS website or from the requesting entity, which often has blank copies available for use. Uncertainty regarding the completion of the form Instructional materials are provided alongside the form by the IRS, which explains in detail how to properly complete it. Tax professionals can also offer assistance when needed. Misplacement or loss of a completed W-9 form It's recommended to keep digital copies of completed forms. In the event of loss, one can quickly fill out another free copy of the W9 form and provide it to the requester. Concerns about the privacy of information on Form W-9 It's crucial to submit W-9 forms only to trusted entities to minimize the risk of identity theft or unauthorized disclosure of sensitive information. By understanding the significance of Form W-9 and learning how to manage common issues, individuals and businesses can ensure tax compliance, thus avoiding potential penalties or legal complications. Fill Now

W9 Tax Form Copy When engaging in various financial and business transactions within the United States, a critical document often comes into play - IRS Form W-9. This form serves a vital function for both individuals and entities, especially when it pertains to tax reporting requirements. The primary purpose of the W-9 tax form is to gather taxpayer identification numbers (TINs), which typically include a person's Social Security Number (SSN) or an employer identification number (EIN). Businesses often require individuals and entities to furnish a W9 blank copy to correctly report income paid to the IRS during the fiscal year. Who Should Not Use Form W-9 Despite its broad applicability, certain individuals are exempt from using Form W-9. Typically, this includes non-resident aliens, corporations that are not S corporations, and limited liability companies that are taxed as corporations, among others. These entities and individuals must use different documentation, such as Form W-8, to adhere to their unique tax reporting obligations. Form W-9 in Practice: A Hypothetical Scenario Consider Jane Doe, an independent graphic designer who just landed a contract with a new client. Before she can receive any payment, her client requests that she provide a copy of the W9 form. Jane finds a free copy of the W9 form online, fills it out with her details, including her SSN, and submits it to her client. By doing so, Jane ensures that her client can accurately report the compensation paid to her for her services at the year's end. This information will appear on the Form 1099-NEC that Jane will receive, detailing the total payments, which she can then use when filing her taxes. Common Issues and Solutions with Form W-9 Common Issues Solutions Difficulty in obtaining a W-9 form Individuals can easily get a copy of the W9 directly from the IRS website or from the requesting entity, which often has blank copies available for use. Uncertainty regarding the completion of the form Instructional materials are provided alongside the form by the IRS, which explains in detail how to properly complete it. Tax professionals can also offer assistance when needed. Misplacement or loss of a completed W-9 form It's recommended to keep digital copies of completed forms. In the event of loss, one can quickly fill out another free copy of the W9 form and provide it to the requester. Concerns about the privacy of information on Form W-9 It's crucial to submit W-9 forms only to trusted entities to minimize the risk of identity theft or unauthorized disclosure of sensitive information. By understanding the significance of Form W-9 and learning how to manage common issues, individuals and businesses can ensure tax compliance, thus avoiding potential penalties or legal complications. Fill Now